Guide to Freelancing in Germany

Welcome to our comprehensive guide on freelancing in Germany. This handbook will provide you with all the essential information, tips, and resources you need to succeed as a freelancer in this country.

If you're considering embarking on a freelance career in the Bundesrepublik, you've come to the right place — and we’re not talking only about this guide. Data demonstrates that, in 2023, freelancing in Germany is both blooming and encouraged by third parties, meaning that, if you’re hustling near the Rhine, the Spree, or the Isar rivers, you’re in an excellent spot if you want your independent working business to kick off.

Just in case — what is freelancing?

Freelancing refers to working independently as a self-employed professional, offering services to multiple clients without being tied to a single employer. As a freelancer, you can choose your projects, set your rates, and determine your own working hours.

Why Germany is a good place for freelancers in 2023

By many scales, the freelance occupation has been booming in Germany — and for a while now. The first considerable fact to illustrate this boom is how the number of freelance colleagues has increased in the country. The number of freelancers in Germany has increased significantly over the past few decades. In 2022, there were almost 1.5 million registered freelancers in Germany, which is nearly three times as many compared to 1992, according to Statista. Between 2015 and 2022, well over 150 million freelancers joined the ranks.

According to Freelancer.com, Germany is one of the fastest-growing regions for freelancing in the world. The number of new users on the platform increased by 156% from June to September 2021. The rise of freelancing in Germany may be influenced by factors such as inflation, the cost of living, layoffs and skills gaps. Malt, another freelancer marketplace, also reports that Germany is a high-growth market for them, with 17.8% of their European freelancers registered there.

Understanding the freelancing landscape in Germany

As we’ve observed, freelancing has become increasingly popular in Germany, with metrics demonstrating its adoption booming my different scales. Before diving into what it takes to freelance in 2023, let's first understand the German freelance landscape.

Benefits of freelancing in Germany

Flexibility

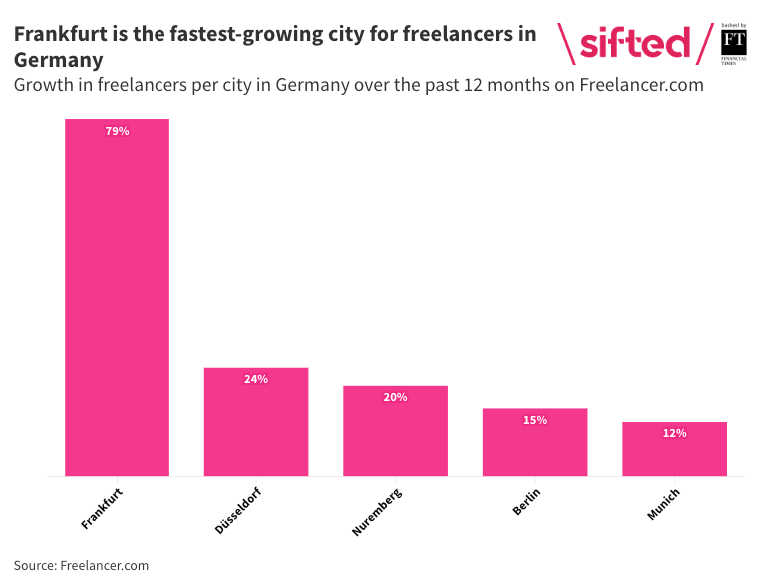

Freelancing allows you to control your schedule, allowing you to work when you feel like it, take off leisure days, and spend mornings hiking — considering you’ve met deadlines, that is. So, when freelancing, and just like in the Netflix hit show Dark, the critical question is not only where, but also when: While freelancing, you can control your schedule provided you’re well-organised. Moreover, in a landscape loaded up with coworking spaces, high-speed internet connections and helpful AIs, freelancers should never downplay the ability to work from wherever they want. With fewer mandatory trips to the CBD and the concept of relocating for work only sounding a bit off, it might not be a coincidence that 2022 data showed how Frankfurt, which is 11% less expensive than its Bavarian counterpart Munich, grew its freelancer base more than any other German city.

Tax Advantages

In Germany, the tax code becomes your best ally as a freelancer. You can bid goodbye to paying taxes on necessary expenditures for your work, as these can be deducted as business expenses. Fancy that new laptop or software that will boost your productivity? As a freelancer, these could potentially become tax-deductible expenses. Perhaps the best part is that this advantage isn't confined to purchases alone; everything from your home office expenses to work-related travel can count.

Diverse Opportunities

The prosperous German economy creates a dynamic work environment, with freelance opportunities in various fields. Germany is a great place to work if you specialise in any field, be it technology, design, or consultancy. The country's dedication to technology and new ideas has also increased the need for independent contractors. Diversity in Europe's economic hub is not limited to a wide selection of brews — “it’s not only about the Weiss biers, lads” — but extends to a wide range of job openings.

Work-Life Balance

With freelancing, work-life balance is more than just a trendy buzzword; it's a reality. Imagine spending more time with your loved ones, pursuing your personal interests, or even taking an impromptu trip to the serene landscapes of the Black Forest or the picturesque towns along the Romantic Road. Freelancing allows you to do just that, provided your phone has enough battery and an unlimited data plan.

Freelancing for a German company while living abroad

The GmbH suffix rings differently, and freelancing for a German company while not residing in Germany is a plausible possibility in 2023. However, there are several factors to consider, particularly around taxation. You’ll soon notice that it isn’t anything that daunting, though.

To begin with, as a non-resident freelancer working for a German company, you would typically be liable to pay taxes in your country of residence rather than in Germany. This is because tax obligations usually depend on your tax residency, which is primarily determined by where you live and work.

However, tax laws can vary significantly between different countries and can get complicated when dealing with international circumstances. Some countries have double taxation agreements with Germany, affecting where and how you pay taxes. Please note that a nefarious-sounding “double taxation agreement” does not mean that each country has joined forces to tax you twice (Internet lore suggests that most remote workers believe it works this way); it’s actually the other way around. For instance, you might be required to declare your German income in your home country and then claim a foreign tax credit or an exemption.

You might want to check which visas you need in case you need to hop on a quick visit to your client’s offices by the Rhine River. It’s also a valuable resource to check to understand how long you can stay in Germany if you want to relocate temporarily or permanently there.

Besides prepping up your visas, here's a rough outline of what you might need to do:

- Check the Tax Treaty: Check whether your country of residence has a tax treaty with Germany to avoid double taxation. As of 2023, more than a hundred countries have taxation agreements with Germany.

- Declare Your Income: You'll have to declare the income you've earned from the German company on your tax return in your country of residence. At least you’ll be able to do it in your mother tongue.

Freelancing on the side of a full-time job in Germany

Freelancing in addition to a full-time job, also known as “side hustling,” is becoming increasingly popular in Germany and the European Union, with official reports estimating that in 2025 there’ll be 43 million platform workers in the region. Side hustling is not the same as being overemployed, and fiscal responsibilities are often less severe than in that case. These are the points you should consider:

- Notify Your Employer: The official speech is that it's crucial to check your primary employment contract and discuss your plans with your employer. Some contracts might have clauses prohibiting additional employment or requiring employer approval. But, oftentimes, it’s not legally necessary to tell your boss about your Python scrapper side project. Choose wisely.

- Understand Your Tax Obligations: Your side income will also be subject to income tax, and you must declare it on your tax return. Remember that Germany has a progressive tax system, so the additional income might push you into a higher tax bracket, although many anonymous side hustlers report that this would only happen if you were working in a B2B system.

- Keep Accurate Records: You must maintain separate, accurate records for your freelance income and expenses. This will make your life easier when it comes to filing your tax return and can help you identify deductible expenses to optimise your taxes and spend that change on a bratwurst with beer and onions.

Getting started as a freelancer in Germany

Now that you’ve considered the benefits and aspects of working as a resident and non-resident, we’ll walk you through the step-by-step process toward your first freelance pay cheque.

Legal Requirements

Even before you begin your freelance journey, it's (well beyond) crucial to understand the legal requirements and obligations in Germany. Here are the key steps to get started:

Registration

Germany distinguishes between commercial businesses (Gewerbe) and independent professions (Freie Berufe). The latter doesn't require registration at the trade office (Gewerbeamt). Freelancers in creative, scientific, teaching, or health-related professions generally fall under “Freie Berufe” and only need to register at the local tax office (Finanzamt). They also need to get a tax number (Steuernummer). You’ll keep stumbling upon the word “Freiberufler” around, and that’s because it means freelancer. Luckily, it’s one of those rare shortish compound words.

Tax Registration

Obtaining a tax number (Steuernummer) in Germany requires a few steps:

- Write down your address: Register your address at a local registration office (Bürgeramt).

- Pay the taxman (a visit): Once you have registered your address, visit your local tax office (Finanzamt). Don’t worry, the “pay the taxman” part was a joke — at least for now.

- Fill out the form and wait: The Fragebogen zur steuerlichen Erfassung, an eight-page form, is required to obtain a Freelance Tax Number. Complete it, and your Freelance Tax Number (Steuernummer) will arrive in 3–6 weeks after submission.

German freelancers and self-employed workers need a Steuernummer to issue invoices and properly process tax on their freelance income. Many clients won't accept invoices without your Steuernummer, as it's a legal requirement.

Insurance

Determine the type of insurance you require, such as health insurance (Krankenversicherung — no, it’s not a trendy Scandinavian limited-edition backpack) and liability insurance (Haftpflichtversicherung). Health insurance is typically mandatory for residents and covers the costs of medical treatment and care. Liability insurance is not mandatory but is strongly recommended as it can protect individuals from financial damages resulting from accidents or other incidents where they may be held liable. Insurance can be deductible: You can protect yourself and your wallet in a single move.

Choosing the Right Business Structure

When launching your freelance business in Germany, selecting the appropriate legal structure is one of the first and most crucial decisions you'll need to make. The structure you choose impacts your taxes, your liability, and the administrative work you'll have to handle. The two most common options are:

Sole Proprietorship (Einzelunternehmen)

This is the most common and straightforward business structure for freelancers. It offers simplicity, flexibility, and minimal bureaucratic hurdles. As a sole proprietor, you and your business are considered the same legal entity, meaning you're personally liable for all business decisions.

Partnership Company (Partnerschaftsgesellschaft)

If you plan to collaborate with other professionals, a Partnership Company could be a suitable option. It offers a way to share responsibility, costs, and expertise, but does come with increased administrative requirements. Remember, each partner is liable for their share of the business liabilities.

So, note how, In Germany, freelancers typically don't form a Freiberufler-GmbH, which would equal an Ltd. suffix in the United Kingdom or an LLC in the United States.

Taxation and Accounting

Understanding your tax obligations and maintaining a strict accounting practice is critical in keeping your freelance career free of legal issues.

Income Tax

Germany operates on a progressive income tax system, meaning the more you earn, the higher your tax rate. The tax rates vary from 14% to up to 45%.

| Income Bracket (EUR) | Germany Tax Rate | France Tax Rate |

|---|---|---|

| 0 - 9,408 | 0% | 0% |

| 9,408 - 57,051 | 14% | 11% |

| 57,051 - 270,500 | 42% | 30% |

| 270,500+ | 45% | 45% |

It's crucial to understand these rates and file your income tax returns accordingly to stay in the good graces of the Finanzamt. Due to Germany’s onerous taxation system, It’s also a very good idea to file taxes in your country if you’re not German.

Value Added Tax (VAT)

Depending on your annual turnover, you might be subject to VAT. If your income is less than €22,000 in your first year and expected to be less than €50,000 in the following year, you're classified as a small business (Kleinunternehmer) and are exempt from VAT. You'll need to register for VAT and charge it on your invoices if you earn more.

Bookkeeping

Keeping accurate records of all your income and expenses is not just important – it's a legal requirement. This can be done by hiring an accountant or using accounting software. Remember to keep all your receipts and invoices, as they are your proof of income and expenditures. And, more significantly, don’t fall for the trendy TikTok clips in which influencers nail down their taxes with a moleskin notebook, a frosty Kombucha drink, and a couple of highlighters. That’s simply not possible in 2023 unless you want to miss a deadline, pay an insufficient amount to the State, and enter the analogue-taxpayer-to-white-collar-criminal pipeline.

Finding Clients and Marketing Your Freelance Services

Building a successful freelance career requires more than just being great at what you do. You must establish a solid client base and ensure potential clients can find you.

Building Your Online Presence

Your online presence is your digital shopfront. A professional website showcasing your skills, portfolio, and contact information is essential; it’s equally important to hone and kick your resume upstairs — and live to tell it.

64% of professionals at the top of their industry are increasingly choosing to work independently

Source: From a Survey from Upwork, 2020

If you indeed have a website, optimising your website content with relevant keywords through Search Engine Optimization (SEO) also helps improve your visibility in search engine rankings. And please remember the power of social media – platforms like LinkedIn, Xing (popular in Germany), Instagram, or Twitter can be excellent tools to promote your freelance services and engage with potential clients.

Networking and Collaboration

In the freelance world, who you know can sometimes be as influential as what you know about PHP or C++. Attending industry events such as conferences, seminars, and meetups can help you network with professionals in your field.

46% – Friends and family

40% – Social media

38% – Previous freelance client

36% – Professional contacts

27% – Online ads/classifieds

23% – Online job boards

Joining online communities and forums dedicated to freelancing — or to the discipline you’re pursuing — also offers opportunities to connect with fellow freelancers, share insights, potentially find collaborative projects, and simply vent and rant about a late-paid invoice.

Overcoming Challenges and Ensuring Success

You heard the old chestnut about Germans hiking: they’ll ramble around, never get tired, and constantly repeat that the goal is the way. Freelancing might be a tad less demanding than walking through the Alps with a Bavarian couple, definitely, but it still comes with its challenges — and you should make them part of the way if you want to achieve your goals. These are the three best themes you can develop when freelancing for German companies:

1. Time Management

Freelancing offers splendid flexibility, but it also requires exceptional time management skills. Developing effective strategies to manage your time can help ensure productivity and maintain a healthy work-life balance. Experts in time management seem to also be experts in cashing in additional pay cheques, and it can’t be a coincidence, so pay attention to their best practices.

2. Client Communication

Clear and consistent communication with clients is critical to a successful freelancer-client relationship. This includes setting mutual expectations, providing regular updates, and handling feedback professionally. If you get told off, or your delivery is off, be resilient and don’t take it personally — it’s all about earning the cash to spend it with your SO in a hot dog stand by the waterfront.

3. Continuous Learning

The freelance landscape is constantly evolving. To remain competitive, it's essential to stay updated with industry trends, continually expand your skill set, and embrace lifelong learning. In 2023, you might fall behind if you’re not up-to-date with the yet-to-be-launched AI products!

Summary

Congratulations! You are now equipped with a comprehensive guide to freelancing in Germany. By following the steps outlined in this guide, building a robust professional network, and continuously honing your skills, you'll be on your way to a successful freelance career in Germany.

Remember, becoming a successful freelancer takes time, dedication, and perseverance. Embrace the challenges, stay proactive, and enjoy the rewarding journey of being your own boss.